Today, we’re diving into one of my all-time favorite options trading strategy – the 1-1-2, also called the “112 put ratio” or the “bear trap“. I’ll break down why it’s the greatest trade ever told, its simplicity, flexibility, and how you can use it in various market conditions. The 1-1-2 trade is a straightforward, mechanical strategy that requires no complex technical or fundamental analysis. It can be scaled for different account sizes, boasting a very high win rate and offering literally zero risk to the upside! It provides even larger payouts in case the underlying moves lower, making it a versatile tool for both up and down markets.

The 1-1-2 strategy takes a bold step beyond traditional broken wing butterflies or condors by incorporating two far out-of-the-money puts to finance the debit spread. It involves buying a put around the 25 delta and selling a put around the 20 delta (1-1), accompanied by selling two puts around the 5 delta (-2). With a preference for setups with 45-60 days to expiration, this timeframe allows for significantly distant naked puts while maintaining meaningful credit. The goal is for the two short puts to yield approximately double the cost of the 1-1 debit spread, offering a unique risk-reward profile.

This approach provides an edge by creating a substantial gap between the debit spread strikes and the two short put strikes. The extended distance of the short strikes enhances the probability of profitability and accelerates the initial decay of the overall position. One significant advantage is the absence of upside risk – the trade profits if the price goes up. However, it’s crucial to acknowledge that this strategy introduces noteworthy tail risk, a topic I will delve into in more detail later in this post.

Why the 1-1-2 Trade?

- Simple mechanical execution

- No need for complex technical or fundamental analysis

- Scalable for different account sizes

- Demonstrates an impressively high success rate

- Zero risk to the upside

- Offers larger payouts in case of an underlying move lower

- Multiple paths to success and exit strategies

The Basics of the 1-1-2:

- Initiate the trade by buying an out-of-the-money (OTM) put spread on a chosen underlying for a debit.

- Offset the cost of the spread by selling two naked puts further OTM, creating a favorable net credit.

- The goal of this strategy is to collect premium coupled with ways to make even more profit with a decent sell-off.

- Additionally, it provides an opportunity to purchase the underlying asset at a significant discount.

- This approach can be applied to different underlyings, with my preference specifically for the futures with the most liquid options.

- The trade makes profit in two ways: “tail” profit from the credit received and “trap” profit, combining the maximum profit from the width of the debit spread and the credit received.

Trade Entry and Exit

- Optimal entry window for the 1-1-2 trade is between 45 and 60 days till expiration (DTE). Going further out reduces negative gamma effects and allows for positioning short puts farther out of the money (OTM), but it also increases vulnerability to rapid sell-offs.

- For the put debit spread, start with a 25 delta for the long put. Adjust the width based on the size of the underlying, aiming for $7-10 debit. For the naked puts, start around 5 delta, ensuring you collect 1-2 times the credit of the put debit spread cost.

- Implement a stop loss at 1x max profit unless willing to accept assignment at a 15%+ discount (optional).

- Explore various exit strategies, such as:

- letting it expire for a 100% winner,

- exiting near the “trap” zone,

- closing naked puts at a 95% winner to keep the debit spread as a free hedge (an amazing potential savior in a black swan event),

- exiting for more than a “tail” profit early in the trade if the profit curve allows (during market rallies, I was able to close the 1-1-2 quickly for another credit — it’s a closely guarded secret).

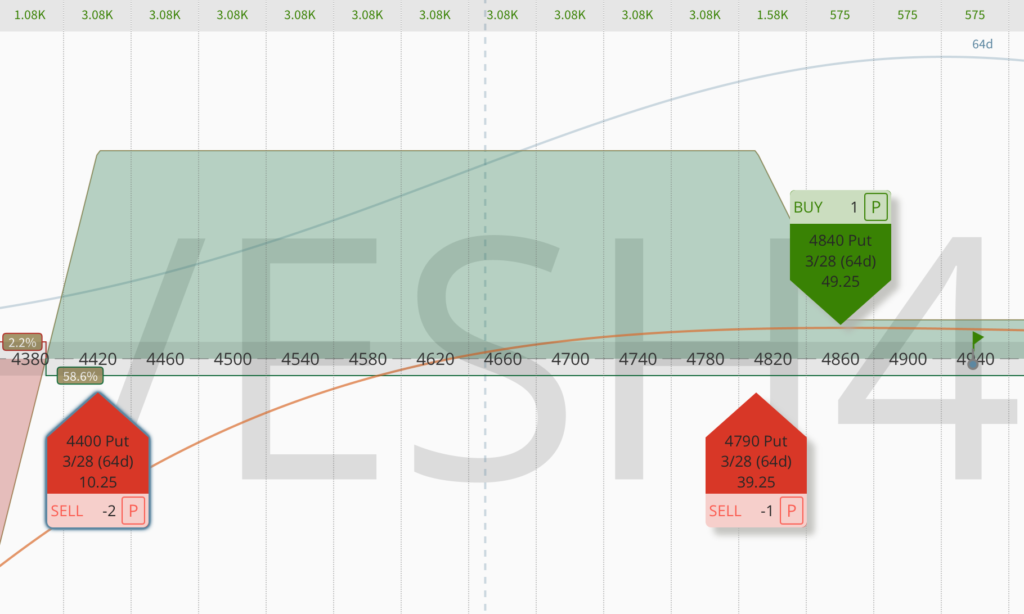

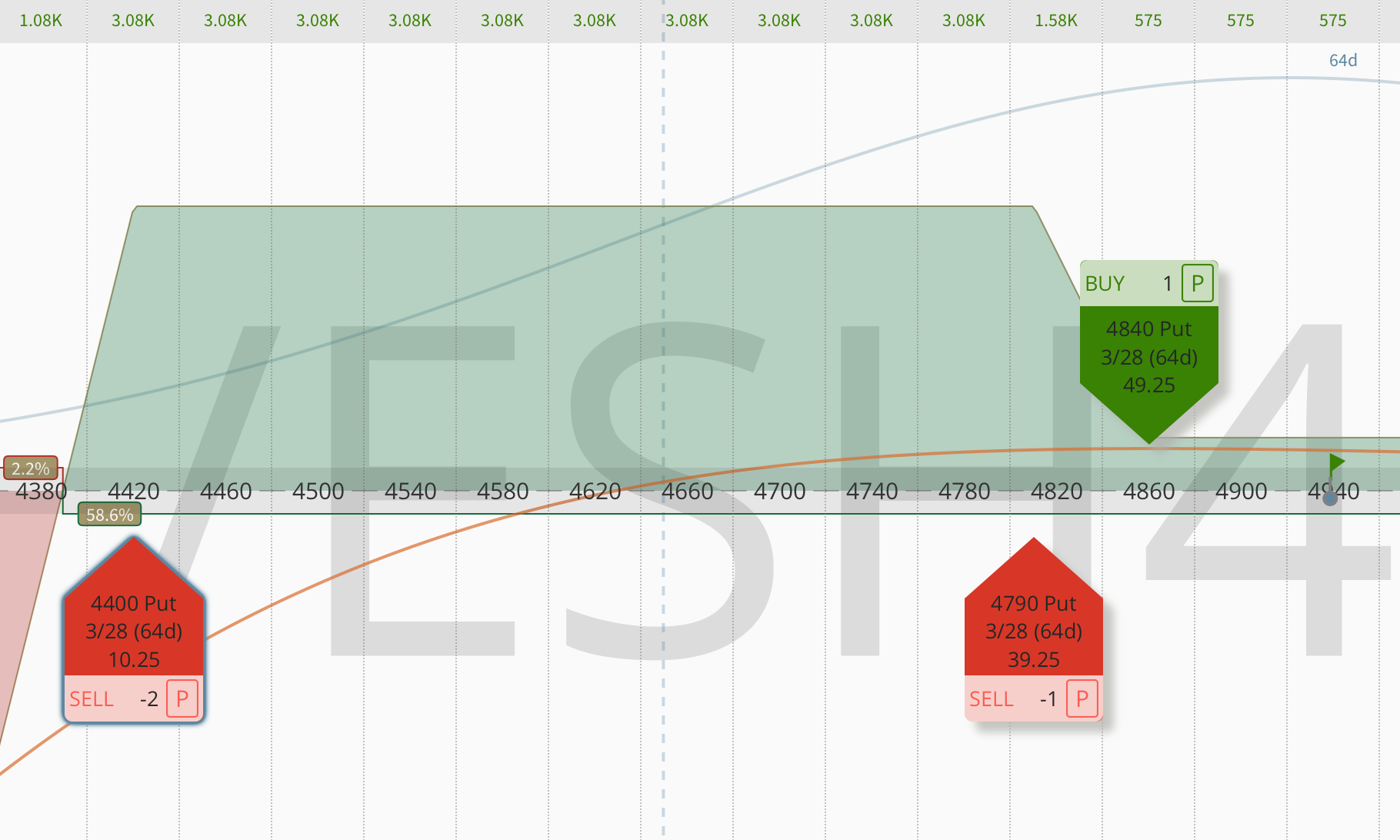

My optimal 1-1-2 trade example on E-mini S&P 500 futures (/ES):

- The put debit spread (1-1):

- Start at 25 delta for the long put

- Buy the 50 wide spread for $7-8 debit

- Far OTM naked puts (2):

- Start at 5 delta, looking for $10-11 credit

- Collect $10-12cr – $550 on $6,500 in buying power

Risks and Adjustments

The 1-1-2 strategy operates in the negative vega zone, where an immediate market downturn could result in substantial unrealized losses. Be vigilant against the danger of buying power expansion risk, as SPAN margin is subject to significant swings when prices move against a position. The downside of this strategy is its significant tail risk, adding an extra layer of caution to your risk management. Therefore, some traders often fortify the 1-1-2 trade with a black swan hedge, which will be discussed in more detail in one of the next articles.

In the event of breached naked puts, there’s no need to panic. Refer to my playbook of management techniques, as detailed in a previous article. Keep in mind the importance of portfolio diversification using non-correlated assets, allocating only a small percentage of your buying power to any single strategy. For a well-rounded portfolio of 1-1-2 trades, consider futures such as gold (/GC), natural gas (/NG), crude oil (/CL), grains (/ZC, /ZS, /ZW), and treasuries (/ZN, /ZB) – all excellent candidates for mastering the 1-1-2 trade!

3 responses to “The 1-1-2 Bear Trap Strategy: Trading with a 95% Probability of Profit”

How are you running your S&P 112 campaign? I’ve conducted extensive backtesting and discovered that 120 DTE, 50% PT, and 2x loss (300% value) hit the sweet spot.

After additional backtesting, it appears that managing the PDS separately at 95% profit from the naked puts (50% PT and 200% SL) yielded much better statistics!

Went from being up 7.5% YTD to being down 16% YTD all because of my size. Had too many units and wasn’t prepared for VIX hitting 60 today!