In this blog post, I will explain everything you need to know about box spreads, which are often considered the closest thing to risk-free options trades. You will learn what a box trade is, why it’s useful, how to construct one, and how to use it for various financial purposes such as generating income, replicating a loan structure, and potentially enhancing your portfolio strategy. In the world of options trading, box spreads have often been overlooked, particularly during periods of low interest rates. However, with current high interest rates opening new opportunities, the box spread is once again emerging as a powerful strategy worth exploring.

What is a Box Spread?

The box trade is an innovative options strategy that allows market participants to borrow or lend cash at very competitive rates. This powerful technique combines two vertical spreads — one call spread and one put spread — to create a position with a guaranteed payoff at expiration, regardless of the underlying asset’s price movement. So, the box involves four positions: long call, short call, long put, and short put. These options form the four corners of the box. Think of it as creating a “box” in the option chain, with each corner representing a different position. The strategy is neutral and not dependent on any directional movement from the underlying asset. Trader can either buy a box spread (taking a long position) or sell a box spread (taking a short position).

Long Box Spread Example

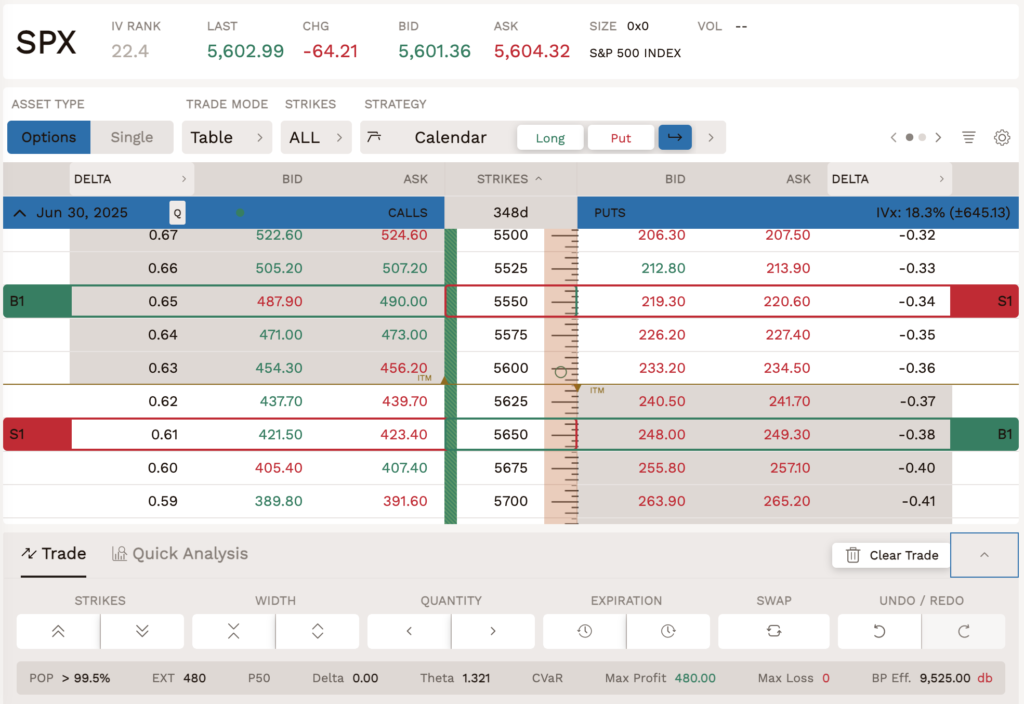

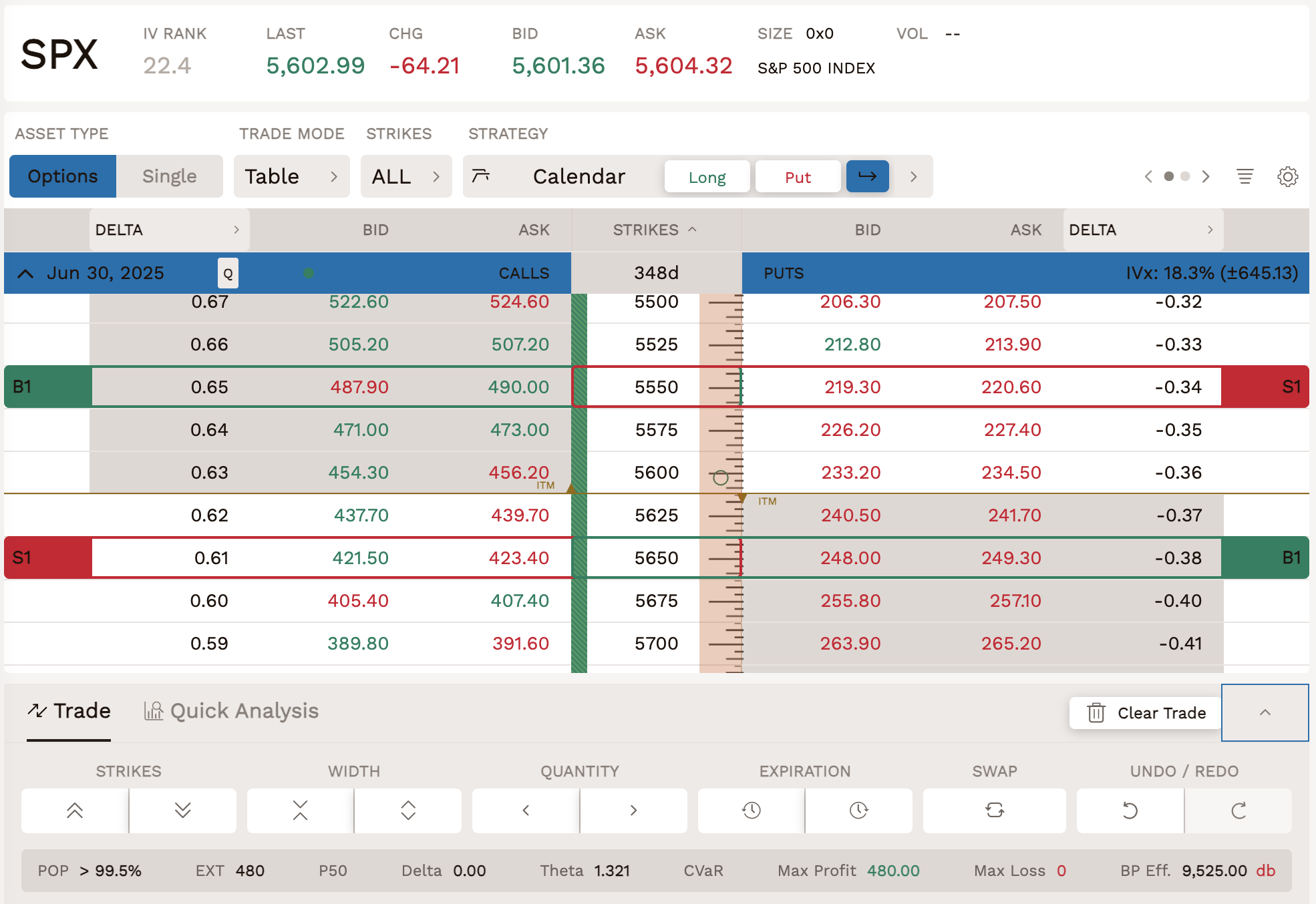

Long box spreads are designed to create a risk-free arbitrage trade. Let’s explain how a short box spread works through a simplified example using S&P 500 Index options. I’ll use the SPX because it involves European-style options, which cannot be exercised early, reducing the assignment risk associated with this strategy. Let’s consider a scenario where the S&P 500 is currently trading at 5,600 points. I’ll construct a box spread using the following options expiring one year from now:

- Buy 5,550 call option for $488.95

- Sell 5,650 call option for $422.45

- Buy 5,650 put option for $248.65

- Sell 5,550 put option for $219.95

The total cost of this trade would be: $488.95 – $422.45 + $248.65 – $219.95 = $95.20 per contract. The spread between strike prices remains 5,650 – 5,550 = 100. With the SPX multiplier of 100, the box spread value at expiration is $10,000. Because it is composed of two debit vertical spreads, initial cash flow from opening a long box position is negative.

In this scenario, the trade can secure a profit of $480 ($10,000 – $9,520) before accounting for commissions. At expiration the long box spread has positive value, exactly equal to strike distance regardless of underlying price. Regardless of where SPX settles, the payoff will be $100 per contract. The $480 profit represents the interest earned on the $9,520 “borrowed” through the box spread over the one-year period. This translates to an annualized interest rate of about 5.04% (480 / 9,520 = 0.0504 or 5.04%). It’s important to note that this example assumes perfect execution at mid-market prices. In reality, bid-ask spreads, commissions, and market inefficiencies can impact the actual outcome.

When placing the order, ensure that it is a single box spread trade order so that all four options are executed simultaneously. You can adjust the size and maturity of a box spread by choosing different strike prices and option expirations. A larger difference in strike prices results in a greater amount loaned, and a longer expiration period means a longer duration for the loan. It’s important to note that the availability of option strikes and expirations for a specific underlying security may limit the size and maturity of a box spread.

An Alternative to Treasury Bills?

Consider using box spreads as an alternative to income-generating assets such as U.S. Treasuries. The cash flow from a long box trade resembles that of a zero coupon bond, offering a small profit similar to bond interest when options are fairly priced. Box spreads also offer flexibility with customizable expiration dates and notional amounts. They might yield slightly higher returns than equivalent Treasury bills, possibly due to a “convenience yield” present in the market.

A appealing advantage of box spreads is their favorable tax treatment. Profits from box spreads are taxed as capital gains, potentially at a lower rate than the ordinary income tax applied to bond interest. This is particularly advantageous if the box spread is held for more than one year, qualifying for long-term capital gains treatment. Additionally, under section 1256 of the Tax Code, transactions in certain exchange-traded options, including SPX, are eligible for a tax rate equal to 60% long-term and 40% short-term capital gain or loss, provided the investor and strategy meet the criteria.

Box Spreads as Cheap Loans

One compelling aspect of box spreads is their potential to serve as cost-effective financing tools. Rather than relying on traditional margin loans from their broker, investors can use box spreads to effectively borrow money from the options market, often at lower rates. Basically, a box spread trade allows you to replicate a loan with a fixed maturity date (loan is automatically closed when the options expire) and pre-determined interest rate. It is like you have issued a zero-coupon bond to a third party and will pay back the par value when the options mature. For instance, you get a credit of $9,520 now and pay back $10,000 a year later.

To establish a box spread loan, you would simultaneously buy a put option and sell a call option with the same strike price and expiration date. Additionally, you would sell a put option and buy a call option with a higher strike price but the same expiration date. This approach results in a net credit, providing upfront funds. This stands in contrast to the long box trade, where the objective is to generate a profit similar to interest earned on a bond. With a box spread loan, the net credit received serves as the loan amount.

Alternatives to Box Spreads

If you’re looking for alternatives to box spreads, there are several options that can help you earn a yield risk-free. One solid choice is government bonds, especially U.S. Treasury securities like T-bills. These are considered safe investments that provide fixed income over various maturities. Another easy alternative is to consider ETFs that focus on short-term government securities, such as BIL. This ETF tracks U.S. Treasury bills and allows you to invest in government securities without the hassle of managing individual bonds, making it a straightforward choice for cash management.

Additionally, if you’re with Interactive Brokers, their cash yield program is worth checking out (earn up to $1000 worth of IBKR stock by using our referral link). This program lets you earn interest on any uninvested cash sitting in your account, allowing your money to work for you without diving into complex trading strategies. So, whether you opt for government bonds, ETFs like BIL, or take advantage of cash yield programs, there are plenty of alternatives to box spreads that can help you optimize your portfolio and generate some extra income.

One response to “Box Spread – Your Secret Weapon for Risk-Free Options Trading”

Great overview of box spread, but I love the story about Robinhood user, who tried to set up a box spread with just $5k in his account, he ended up facing a loss of over $60k after some options were exercised against him. It’s wild how this incident led to Robinhood banning box spreads altogether!