-

The Flyagonal: A Hybrid Options Trading Strategy With a 96% Win Rate

Every options trader knows the fundamental trade-off: you can collect theta, but you expose yourself to vega. You can position for a volatility spike, but you’ll bleed premium when the market goes quiet. It’s a constant battle. So when a strategy claims to handle both rising and falling volatility while generating consistent income, skepticism is…

-

Beta-Weighted Delta: The One Number That Matters in Portfolio Risk

Every options trader knows delta. It’s one of the first Greeks you learn, because it tells you how sensitive a position is to changes in the underlying price. A delta of +50 means a $1 increase in the stock adds $50 to your position’s value. A delta of –50 means the opposite, you gain if…

-

The Black Swan Hedge: Protect Your Portfolio from Market Crashes

In investing, most strategies assume the market behaves in a “normal” way. But anyone who’s been trading for a while knows that markets can be wildly unpredictable. Rare, extreme events, called “Black Swan” events, can come out of nowhere and crash the market, causing severe losses. That’s why I find the Black Swan Hedge so…

-

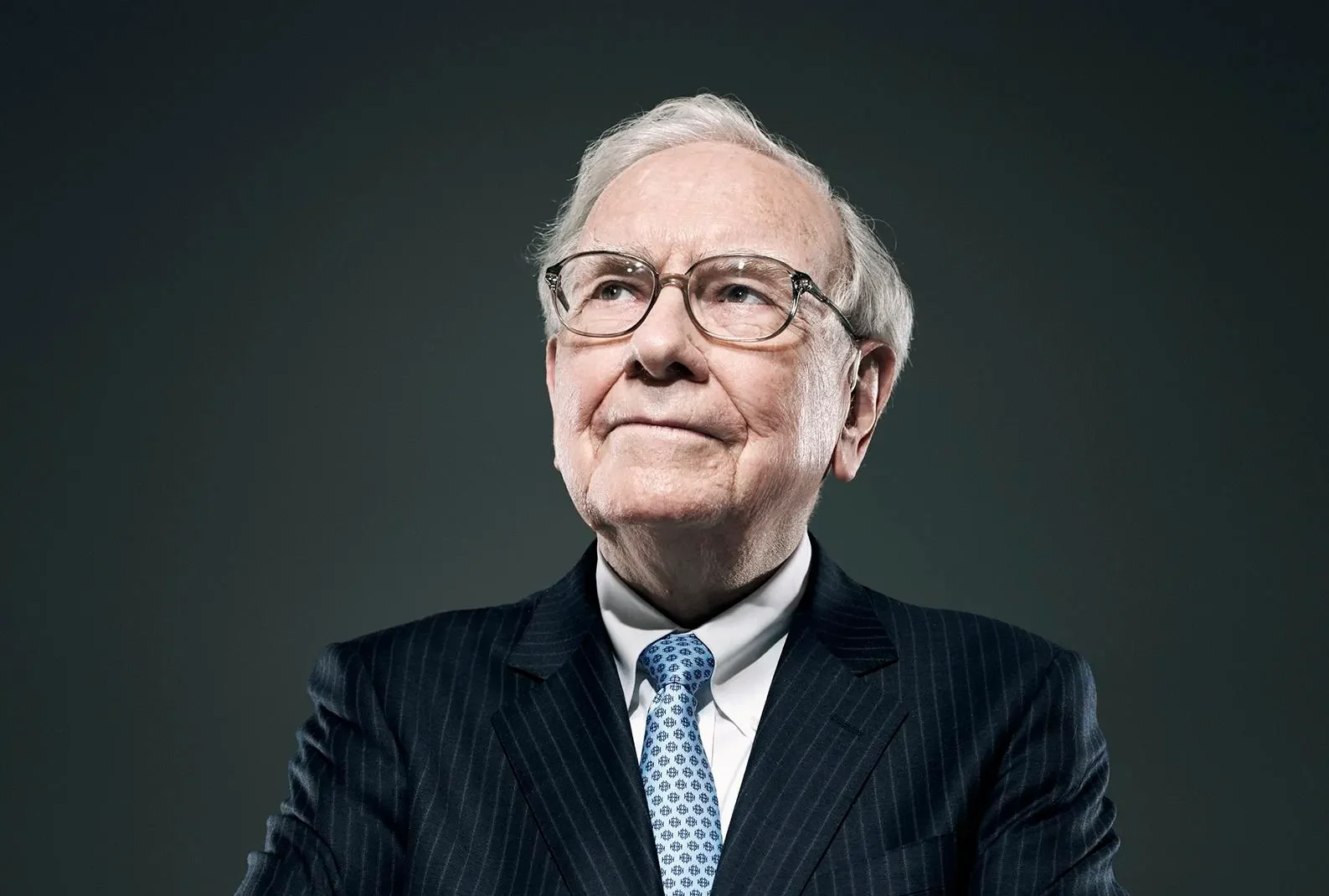

How Warren Buffett Trades Options: The Oracle of Omaha’s Secret Strategy

Warren Buffett is famous for being a master of value investing. He looks for companies with strong, lasting advantages and buys their stocks when the price is right. But here’s something many investors don’t know: Buffett also uses options in a smart and strategic way. While some assume he avoids derivatives entirely, that’s far from…

-

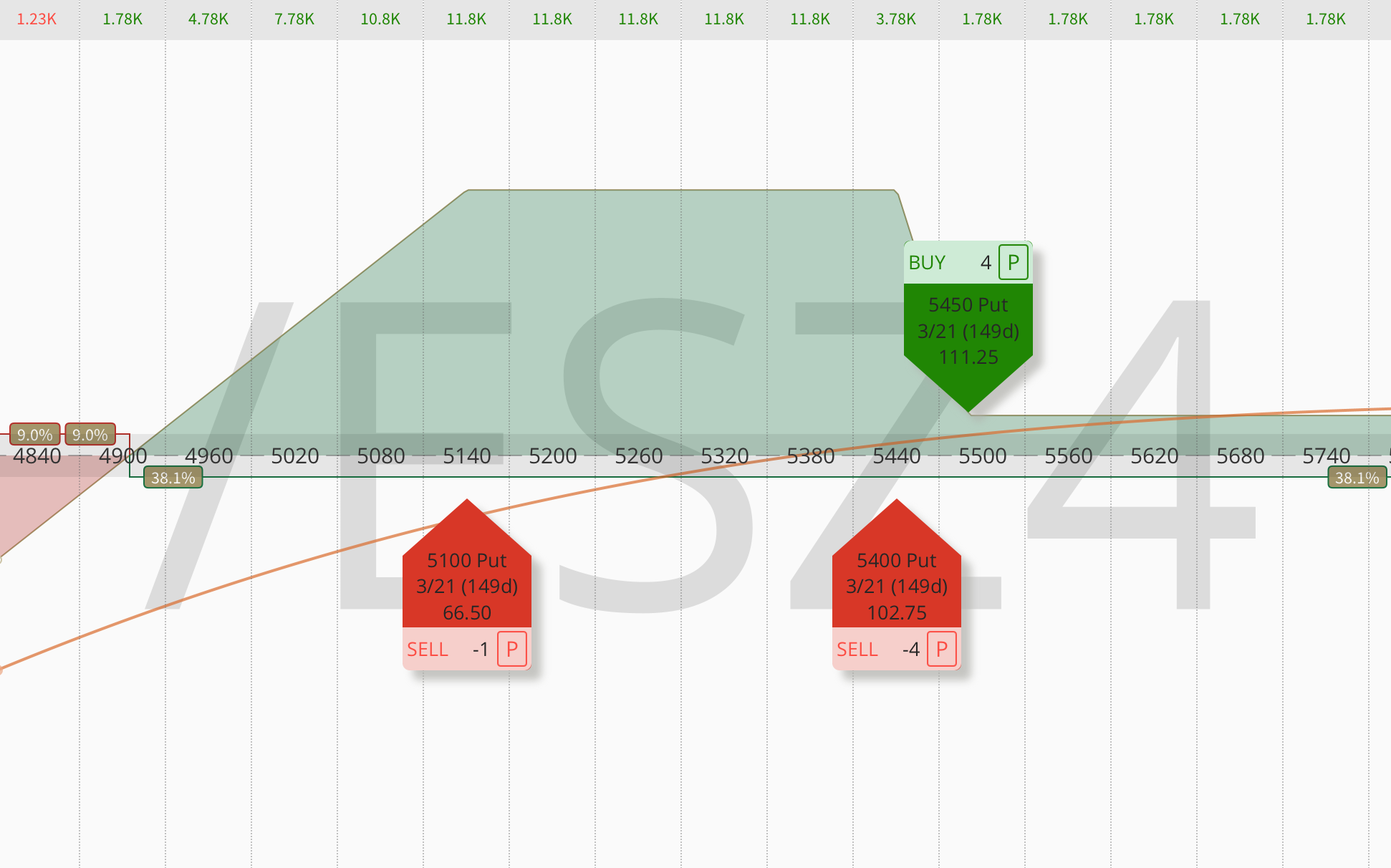

The 1-1-2 Trade: Is It Really Worth the Risk? Discover Safer Alternatives

The 1-1-2 options trading strategy presented in my previous article has been gaining popularity among traders, especially in several online communities. But before jumping on the bandwagon, it’s important to understand that this trade may not suit every trader, especially during volatile market conditions. In this post, we’ll explore the origins of the strategy, how…

-

How Howard Marks Changed My Approach to Risk in Options Trading

As someone deeply involved in options trading, I recently came across Howard Marks, the co-chairman of Oaktree Capital. His views on risk, laid out in his new video course, were incredibly insightful and made me rethink some aspects of my own strategy. I found many of his points applicable not just to traditional investing but…

-

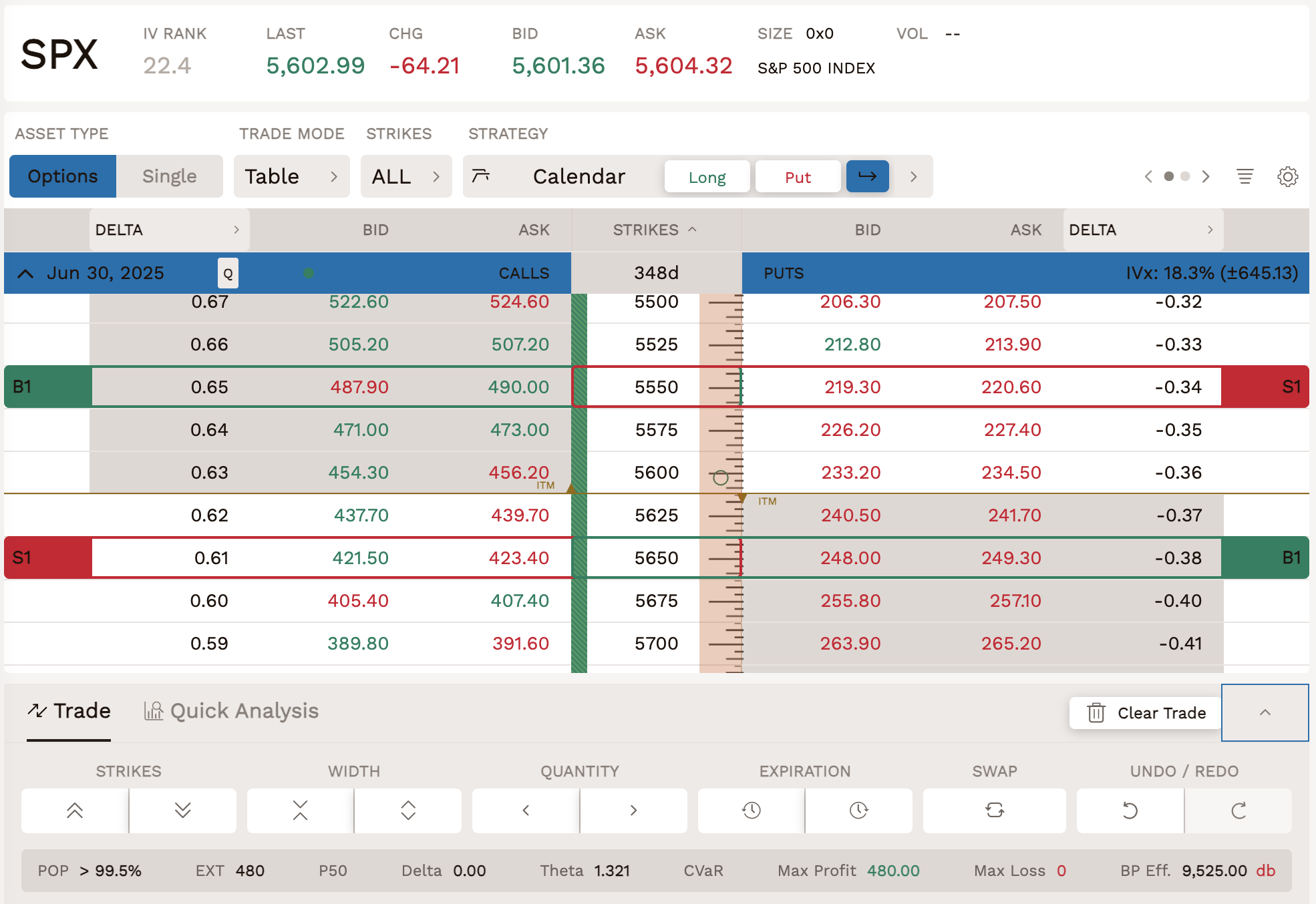

Box Spread – Your Secret Weapon for Risk-Free Options Trading

In this blog post, I will explain everything you need to know about box spreads, which are often considered the closest thing to risk-free options trades. You will learn what a box trade is, why it’s useful, how to construct one, and how to use it for various financial purposes such as generating income, replicating…

-

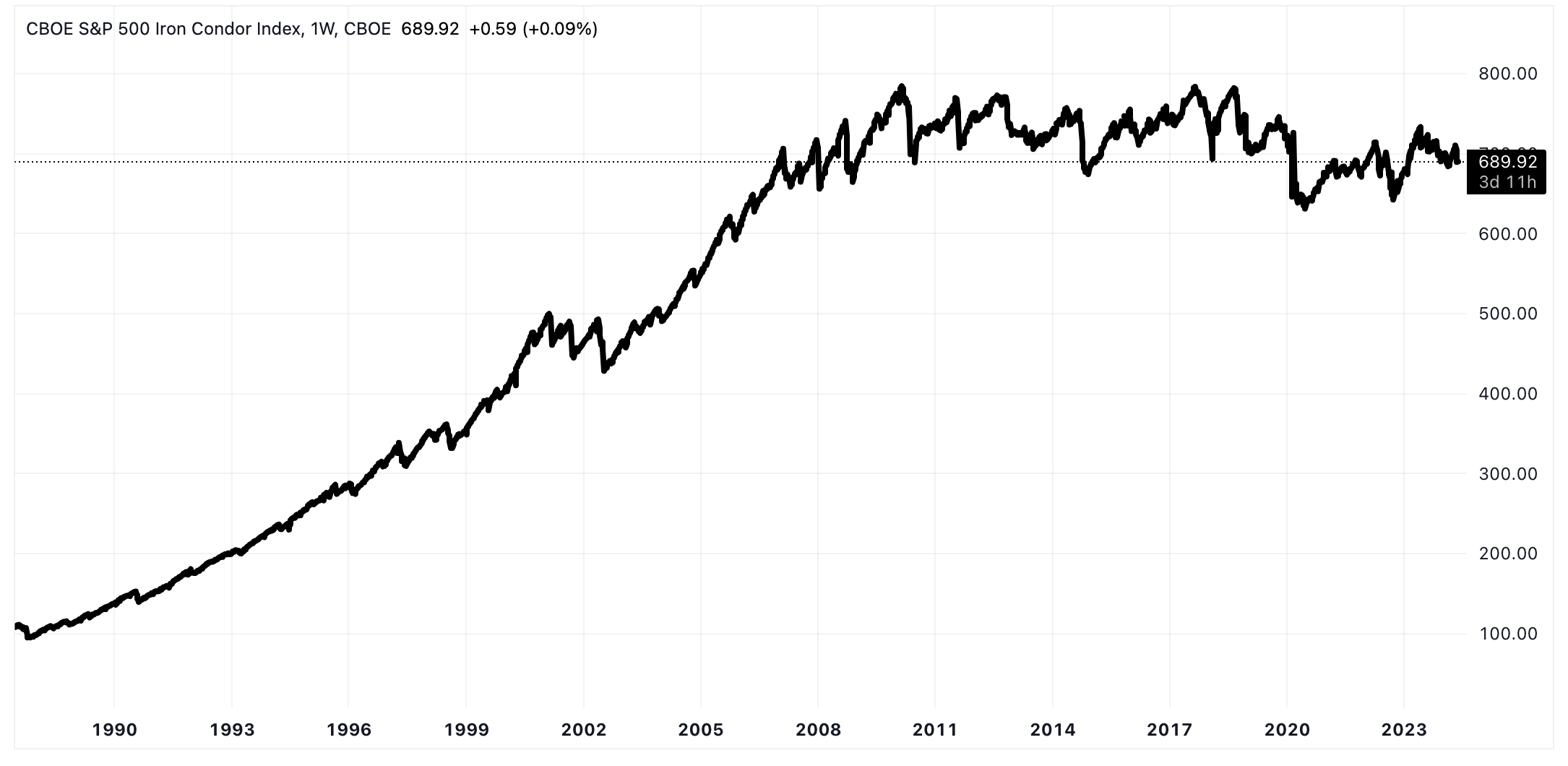

Never Trade Iron Condors Blindly: Here’s How to Actually Profit with This Strategy

Most people’s portfolios don’t have anything that can profit unless the market is going up. Traditional investments, like stocks, need upward movement to generate returns, leaving you with limited opportunities when the market is flat. The Iron Condor options trading strategy offers a compelling alternative by profiting from a lack of significant price movement in…

-

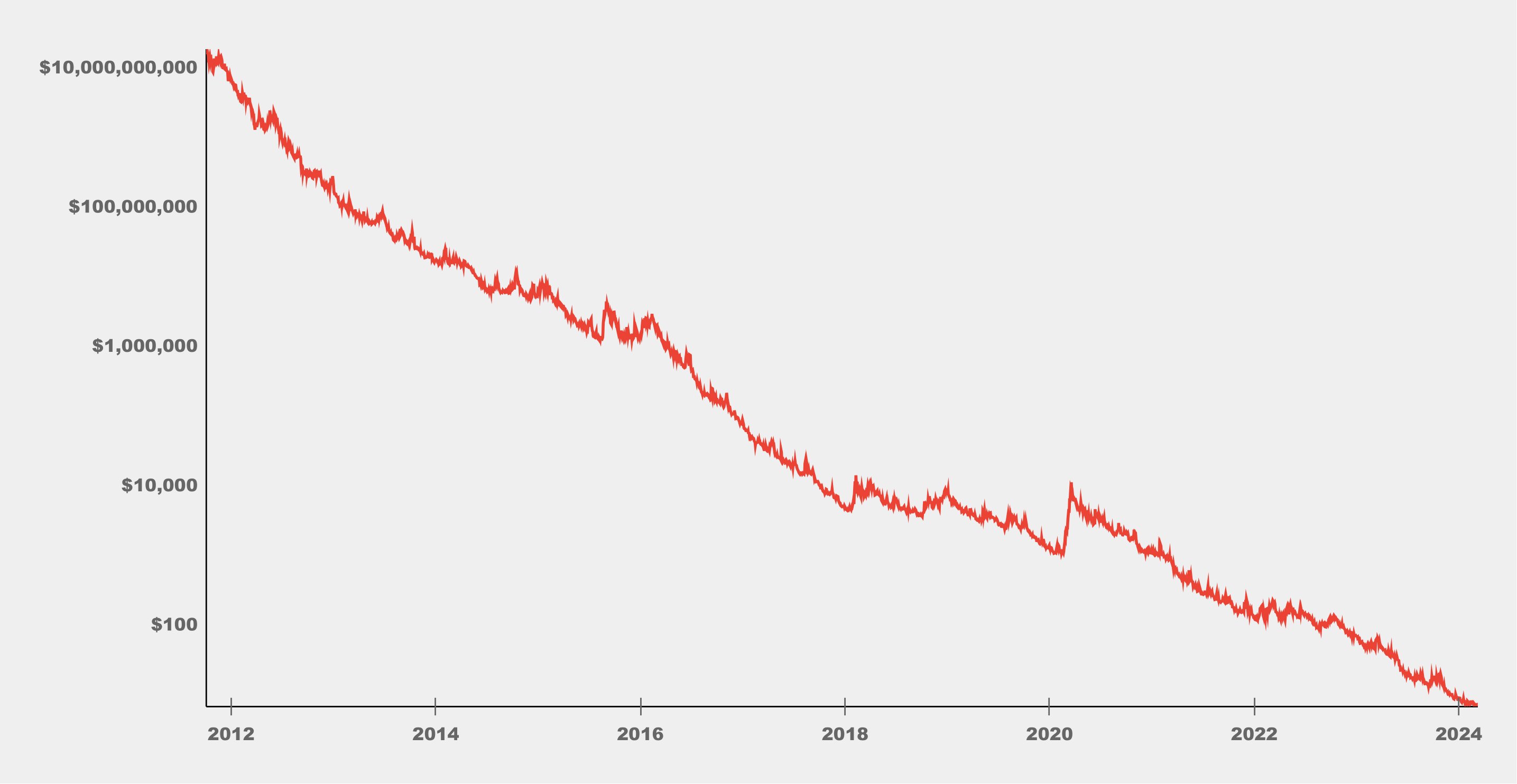

Is VXX Going To Zero? A Guide to Trading Volatility Products

The VIX, formerly the Chicago Board Options Exchange (CBOE) Volatility Index, often referred to as the “fear gauge,” serves as a valuable tool for options sellers like us. It captures market sentiment by rising with increased uncertainty and concern, as reflected by the weighted average of out-of-the-money call and put options on the S&P 500.…

-

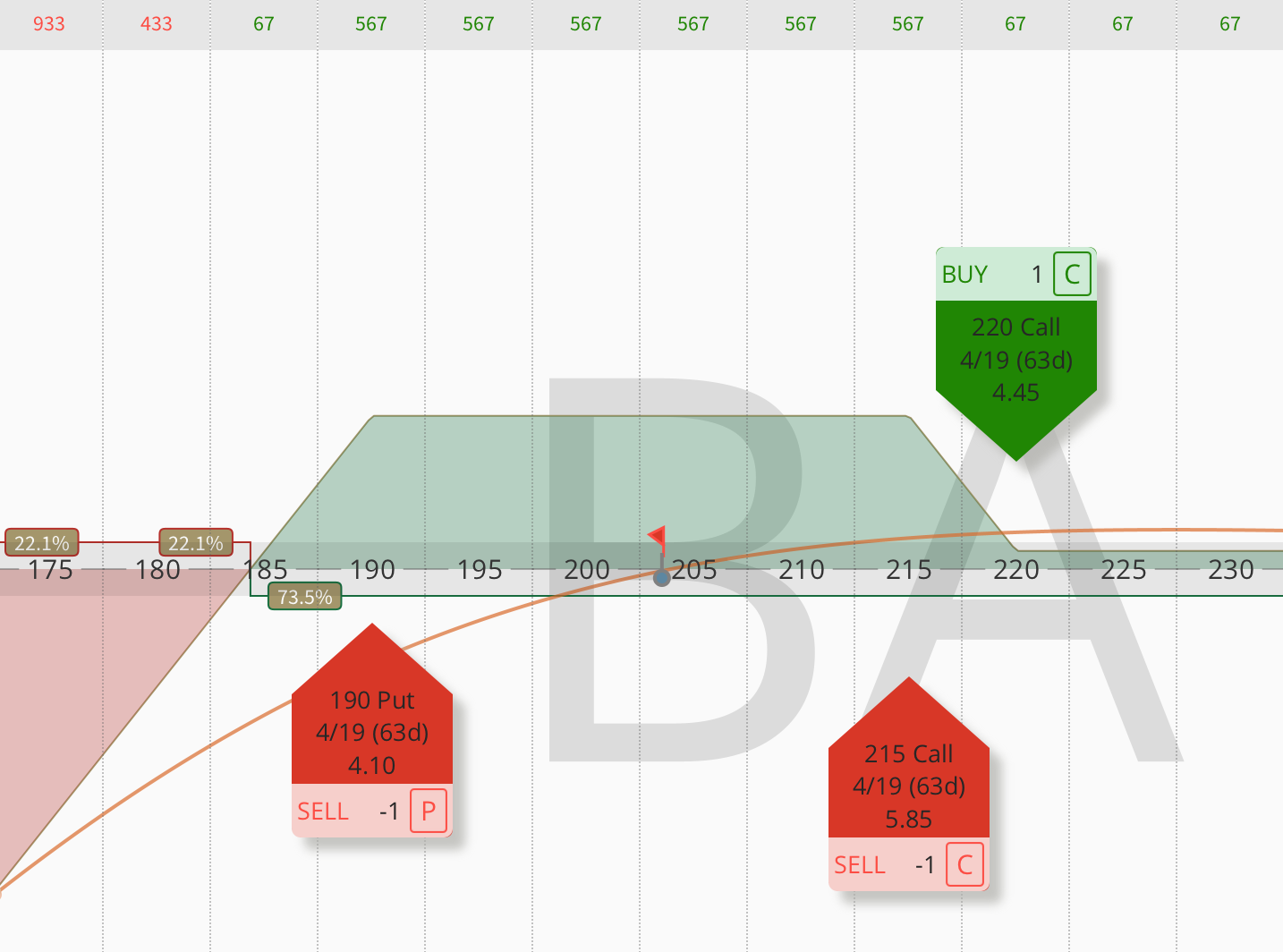

Jade Lizard – A Strategy for a Sold-Off Market with No Upside Risk

Traditionally, neutral strategies such as the strangle or iron condor carry inherent risks on both sides of the market. A substantial move in either direction can be challenging. However, there is a groundbreaking options strategy maintaining a neutral bias while completely eliminating upside risk. It is the Jade Lizard, which allows traders to collect rich…