-

The Flyagonal: A Hybrid Options Trading Strategy With a 96% Win Rate

Every options trader knows the fundamental trade-off: you can collect theta, but you expose yourself to vega. You can position for a volatility spike, but you’ll bleed premium when the market goes quiet. It’s a constant battle. So when a strategy claims to handle both rising and falling volatility while generating consistent income, skepticism is…

-

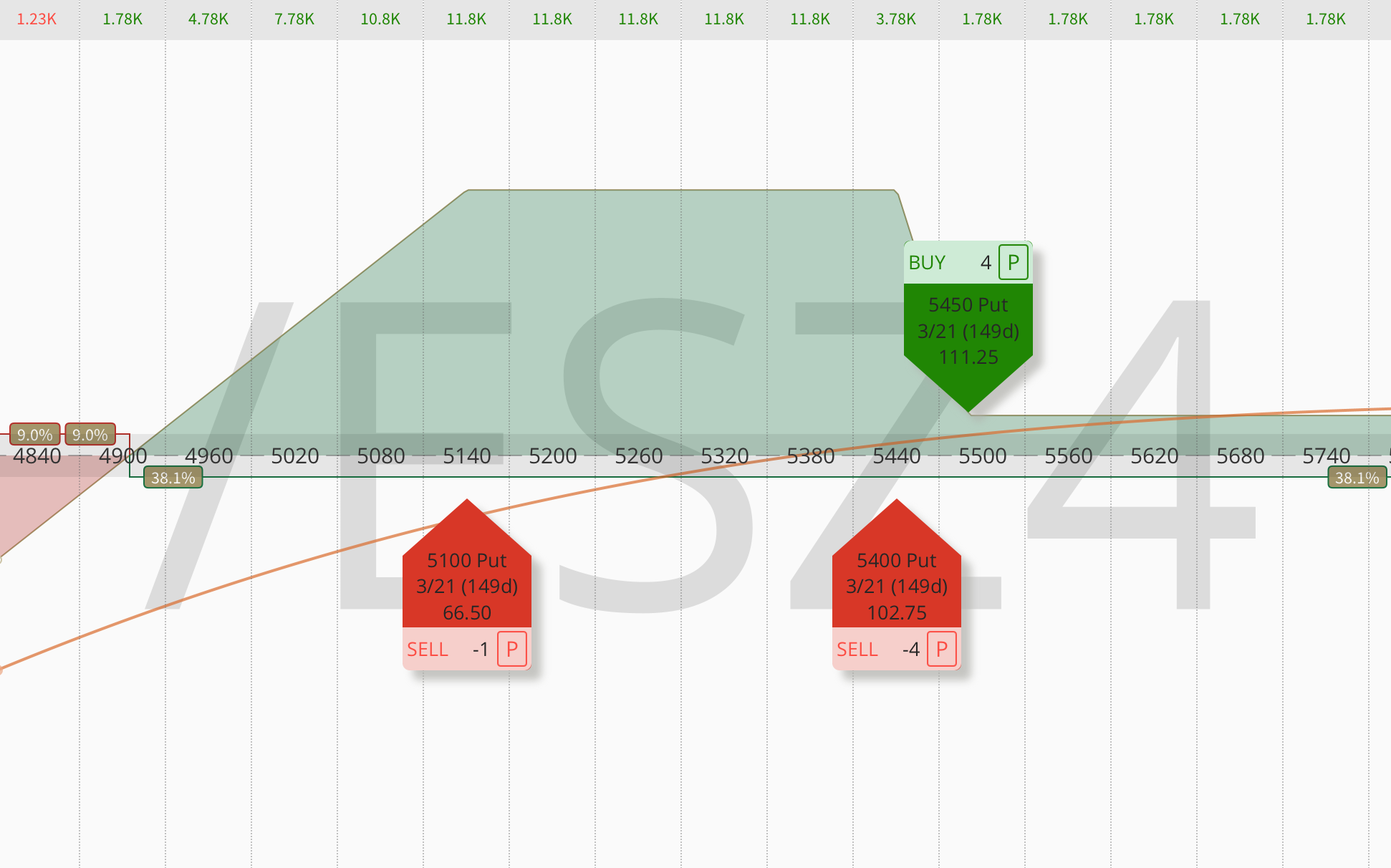

The Black Swan Hedge: Protect Your Portfolio from Market Crashes

In investing, most strategies assume the market behaves in a “normal” way. But anyone who’s been trading for a while knows that markets can be wildly unpredictable. Rare, extreme events, called “Black Swan” events, can come out of nowhere and crash the market, causing severe losses. That’s why I find the Black Swan Hedge so…

-

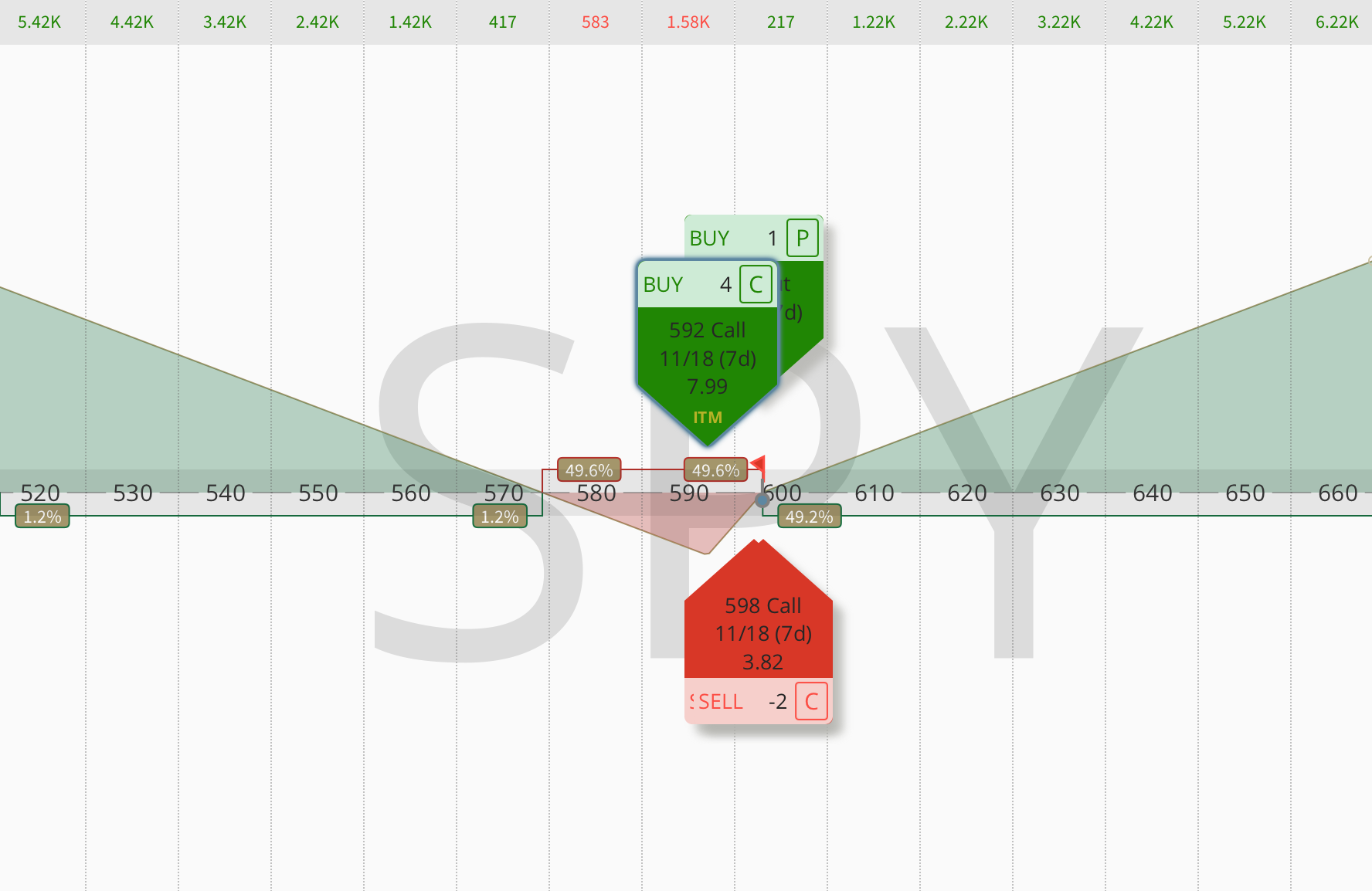

Zero Extrinsic Hedged Back Spread (ZEEHBS): Proven Alpha in Volatile Markets

In options trading, strategies can range from simple to highly complex. The Zero Extrinsic Hedged Back Spread (ZEEHBS) stands out as a sophisticated approach for experienced traders seeking to generate alpha while managing risk. Built on the foundation of the Zero Extrinsic Back Ratio Adjustment (ZEBRA) strategy, ZEEHBS offers a powerful way to capitalize on…

-

The 1-1-2 Trade: Is It Really Worth the Risk? Discover Safer Alternatives

The 1-1-2 options trading strategy presented in my previous article has been gaining popularity among traders, especially in several online communities. But before jumping on the bandwagon, it’s important to understand that this trade may not suit every trader, especially during volatile market conditions. In this post, we’ll explore the origins of the strategy, how…

-

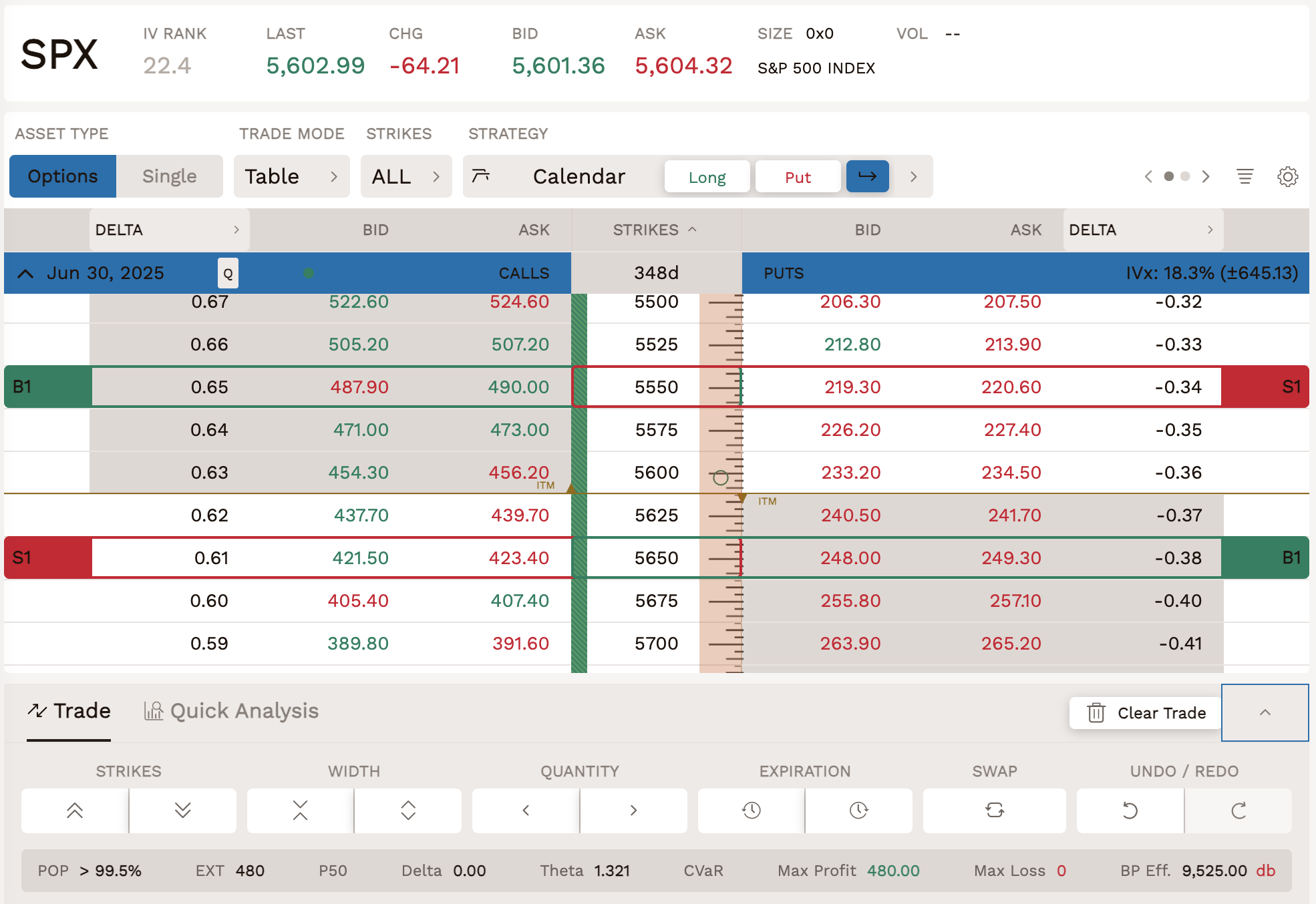

Box Spread – Your Secret Weapon for Risk-Free Options Trading

In this blog post, I will explain everything you need to know about box spreads, which are often considered the closest thing to risk-free options trades. You will learn what a box trade is, why it’s useful, how to construct one, and how to use it for various financial purposes such as generating income, replicating…

-

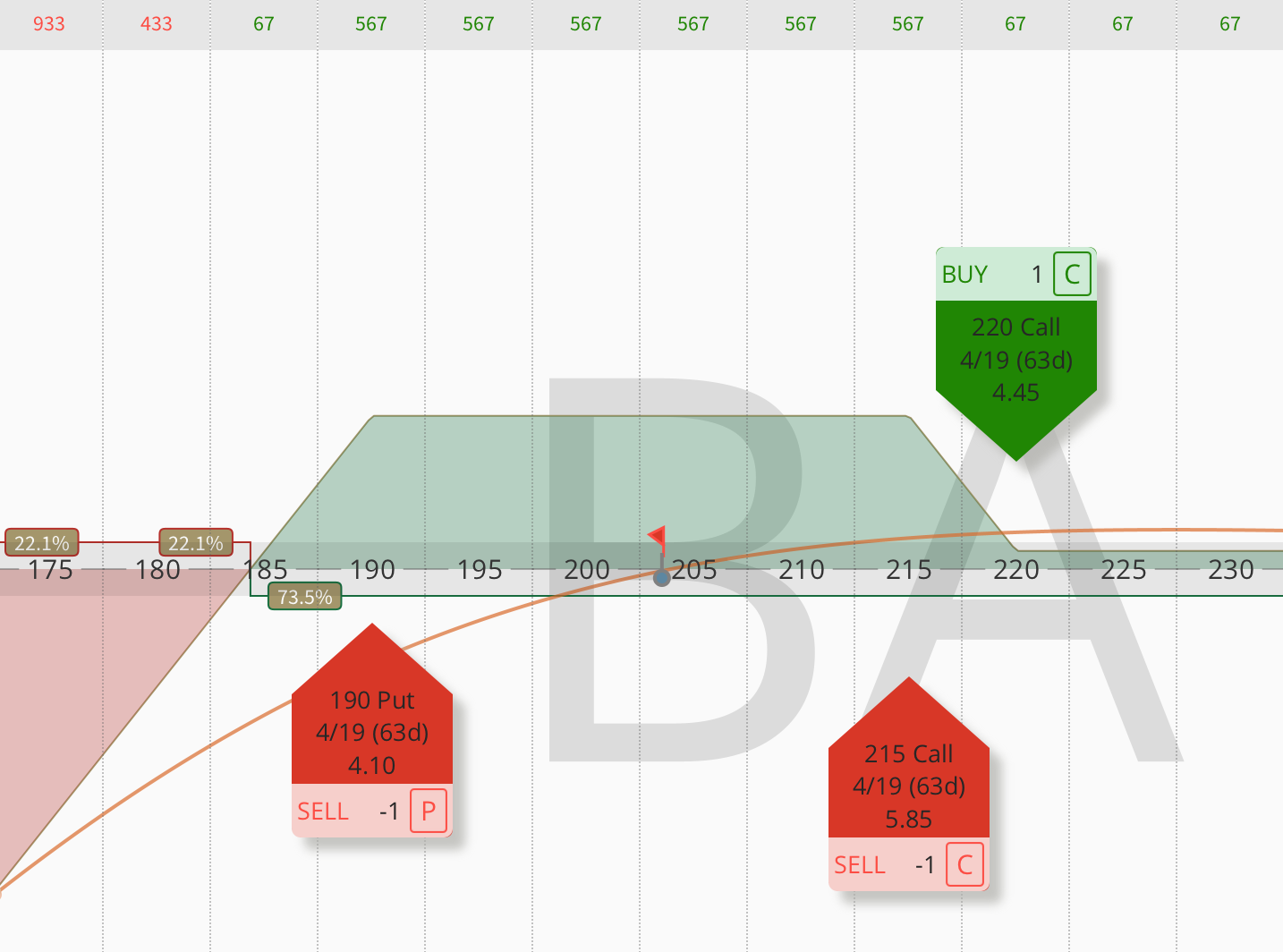

Jade Lizard – A Strategy for a Sold-Off Market with No Upside Risk

Traditionally, neutral strategies such as the strangle or iron condor carry inherent risks on both sides of the market. A substantial move in either direction can be challenging. However, there is a groundbreaking options strategy maintaining a neutral bias while completely eliminating upside risk. It is the Jade Lizard, which allows traders to collect rich…

-

Naked Put Nightmare? No Problem! Here’s How to Fix It.

Ever had a put option trade go seriously south, like way deep in the money? It happens, even to the best of us. Picture this: you’ve tried some smart moves, rolled that put option down and in time, but the trade’s still stuck. Feeling the panic vibes? It’s a common struggle among traders. You could…

-

ZEBRA – the Best Options Trading Strategy for a New Bull Market?

The ZEBRA (zero extrinsic value back ratio spread) allows you to get close to the same directional exposure as owning 100 shares of stock, but with much less risk. It’s my favorite stock replacement strategy. In contrast to other stock replacement strategies such as synthetic long stock, risk reversal, or LEAPs, the ZEBRA provides substantial…

-

How to Invest in US-Listed ETFs from Europe: My Ultimate Solution

If you’re an EU resident looking to invest in US-domiciled ETFs, you’ve probably hit that frustrating wall. Since 2018, EU regulations (specifically UCITS) have made it challenging for retail investors to access US-registered ETFs. This directive requires ETFs to be EU-authorized before they can be marketed to European retail investors. As a result, many popular…

-

Trade Idea: Synthetic Long Bonds using TLT Options

Bonds are generally thought to be the boring, relatively safe part of an investment portfolio. They’ve acted as a safety net, providing a sense of security to investors during turbulent times. However, in 2022, the traditional relationship between stocks and bonds was turned on its head. Bonds were no longer a predictable asset but instead…