Traditionally, neutral strategies such as the strangle or iron condor carry inherent risks on both sides of the market. A substantial move in either direction can be challenging. However, there is a groundbreaking options strategy maintaining a neutral bias while completely eliminating upside risk. It is the Jade Lizard, which allows traders to collect rich premium with a neutral to slightly bullish outlook on an underlying asset. The strategy combines a short naked put and a short call spread, with a total credit greater than the width of the short call spread. It also takes advantage of the implied volatility skew.

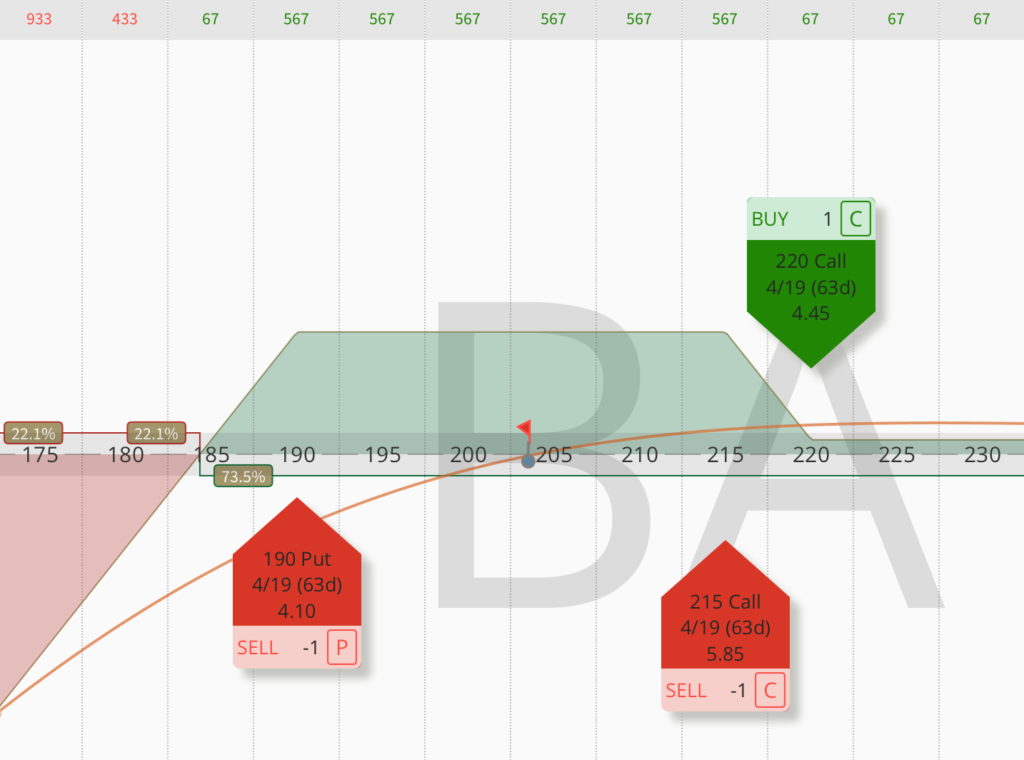

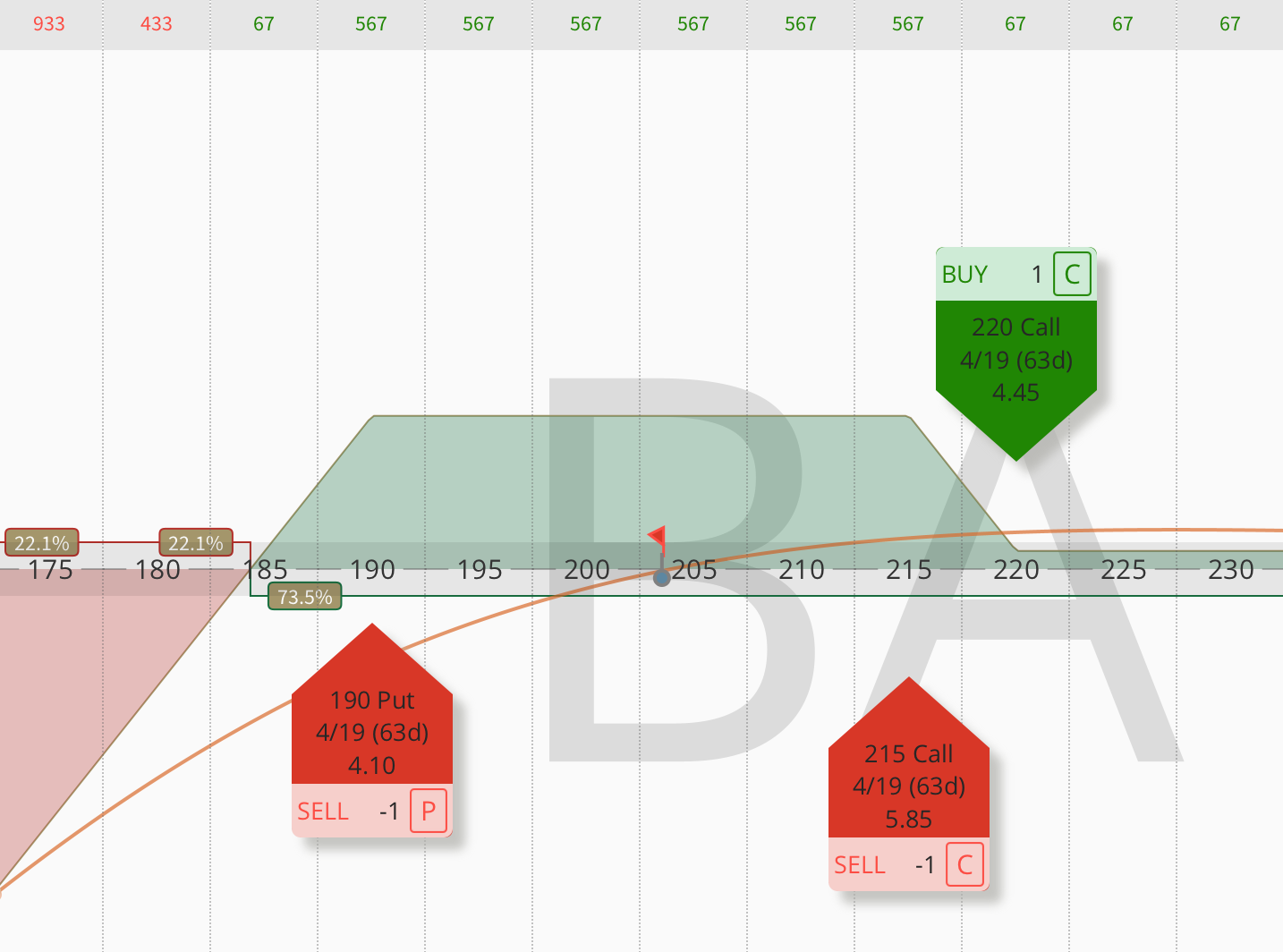

I’ll delve into a real-life Jade Lizard example to potentially provide you with another tool for your trading arsenal. I’ve had my eye on Boeing, a well-known name in the market. Despite some gains in recent days, Boeing has piqued my interest with its impressive 44% IV rank and a recent surge in implied volatility. Considering the uncertainties in the market, I’ve opted for an omnidirectional bias, leading me to my trade idea – the Jade Lizard strategy on Boeing. Here’s the plan: I’m selling the 190 put and a call spread (215/220) with an April expiration (63 DTE). With an 80% probability of profit, my break-even is just under $185, and I’m allocating approximately $2,900 in buying power.

Jade Lizard and IV Skew

Other than the naked put or call, most common options strategies have either two or four legs. So why this three-leg strategy has been created? Because of benefit of using the Jade Lizard over other strategies such as the Iron Condor is it takes advantage of the volatility skew. Due to the skew, IV increases towards lower strikes and decreases towards higher ones. This means the further OTM puts (with higher IV) are relatively more overpriced than the puts closer to the stock price (with lower IV), and the calls are relatively underpriced with an increasing stock price.

The Jade Lizard sells the “more expensive” call and buys the “cheaper” one, and doesn’t pay for the “more expensive” put as the Iron Condor does (however, it uses more buying power). Unlike Strangle, it also eliminates the possibility of unlimited risk to the upside but with some positive delta. The three-leg Jade Lizard’s performance should be somewhere between a Strangle and an Iron Condor. For traders who are very bullish on a stock that has sold off and has a high IVR, strategies such as short puts or covered calls may be more suitable. When the stock has a call-side skew and you’re bearish, consider a reverse Jade Lizard.

Jade Lizard Management

Managing early before expiration improves the Jade Lizard’s return on capital and reduces the downside risk. The trade is closed as a winner by repurchasing the options back for a net debit that is less than the credit collected at order entry. The usual profit target is 50% of the maximum profit or half of the credit initially received at entry. If the stock price breaches the short call spread, you can consider rolling the short put up to collect more credit. However, since there is no upside risk when trading Jade Lizards, this adjustment isn’t entirely necessary.

If the stock sells off and tests the short put, you can roll that put down and out in time for a credit. However, a better option is to roll down the short call spread to collect more credit without increasing the upside risk. This is my preferred move because it improves the breakeven on the side with risk and even adds to the profit potential on the spread if you keep the width the same. Moving the naked option worsens breakeven prices, whereas moving the spread would not. In the worst-case scenario, the entire position can be closed for a loss if the loss on the short put becomes too large.

One response to “Jade Lizard – A Strategy for a Sold-Off Market with No Upside Risk”

How did Jade Lizards perform in the past compared to the naked put?